Getting Started Is Simpler Than You Think

Back in 2016, when we first opened enrollment, one student told us he'd been putting off learning about money for three years. Not because he wasn't interested. He just didn't know where to begin.

We built this platform specifically for people like him. People who want to understand financial planning without wading through textbooks or sitting through lectures that feel disconnected from real life.

Here's what actually happens when you join. No mystery, no gatekeeping. Just a straightforward path from "I'm curious" to "I understand how this works."

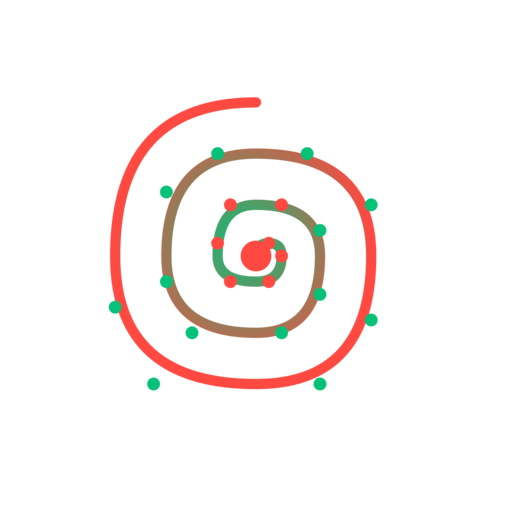

Your Learning Path

We've watched over 2,000 students move through this program since 2015. Some raced through in eight weeks. Others took six months, fitting lessons between work shifts and family commitments. Both approaches work fine. The structure stays the same either way.

You Choose Your Entry Point

Browse the course catalog. Read the descriptions. Pick what makes sense for where you are right now. Complete beginner? Start with budgeting fundamentals. Already tracking expenses? Jump into investment basics. There's no forced sequence unless prerequisites make sense.

Learn at Your Own Speed

Each course breaks into short modules. Ten to fifteen minutes typically. Watch the explanation, work through the example, try the practice scenario. Some people do three modules in a sitting. Others do one per day. Your dashboard tracks progress, but there are no deadlines unless you set them.

Apply What You're Learning

Every module includes exercises based on realistic situations. Calculate retirement savings. Compare mortgage options. Build an emergency fund strategy. You submit your work, get feedback within 48 hours, and see where your thinking was solid or where it went sideways.

Real Scenarios, Not Theory

You'll work through situations that mirror what you'll actually face. Choosing between RRSP and TFSA contributions. Deciding if you can afford that car payment. Evaluating if refinancing makes sense. We use numbers from actual cases.

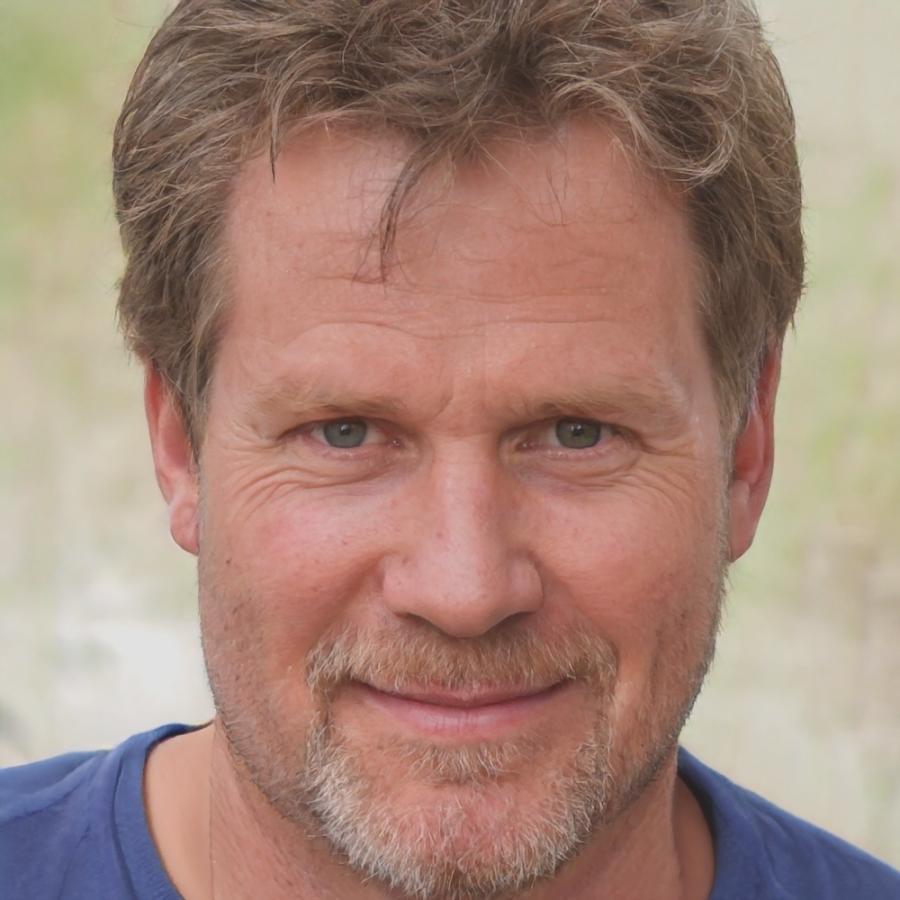

Instructors Who Respond

Questions go to people who've worked in financial planning, not automated systems. You'll get answers that address what you're actually asking, sometimes with follow-up questions to help you think through the problem.

Progress That's Visible

Your dashboard shows completed modules, pending assignments, and courses you've started. Simple progress bars. No gamification, no artificial achievements. Just clear information about where you are.

Access That Doesn't Expire

Once you're enrolled in a course, you can return to it whenever you need. Next year when you're actually buying that house? Come back to the mortgage module. Three years later when you're reviewing investments? The content's still there.

I thought I'd need to quit my job to find time for this. Turned out I could do most modules during my lunch break. Took me four months to finish the core program, working maybe five hours a week. The flexible pacing made it actually doable.